Investing in Dutch AI

ROMs and Invest-NL Unveil the Driving Force Behind the Netherlands' AI Success

Nov 27, 2025

Where Invest-NL unveiled the strategic vision for the Dutch AI sector, the Regional Development Companies (ROMs) demonstrate today that this strategy is already well underway. In a joint 'Deep Dive' analysis, written by AI expert Stefan Leijnen, they reveal a portfolio of 96 AI-native startups that form the backbone of the Dutch AI economy. But the report does more than that. It exposes where the Netherlands stands in the global AI race, what the bottlenecks are, and how we can bridge the gap between vision and world leadership.

AI Deep Dive: Strategic investing in the age of intelligence

On November 27, we analyzed the article in Het Financieele Dagblad where Invest-NL advocated for a sharp, future-proof AI strategy [1]. The core message was clear. The Netherlands should not compete with the US or China in creating larger language models, but rather build on Europe’s strengths. The focus is on energy-efficient AI, high-quality data, and integration with the physical world. Now, this vision is supported by concrete data and a straightforward analysis.

The 96 hidden champions and their distribution

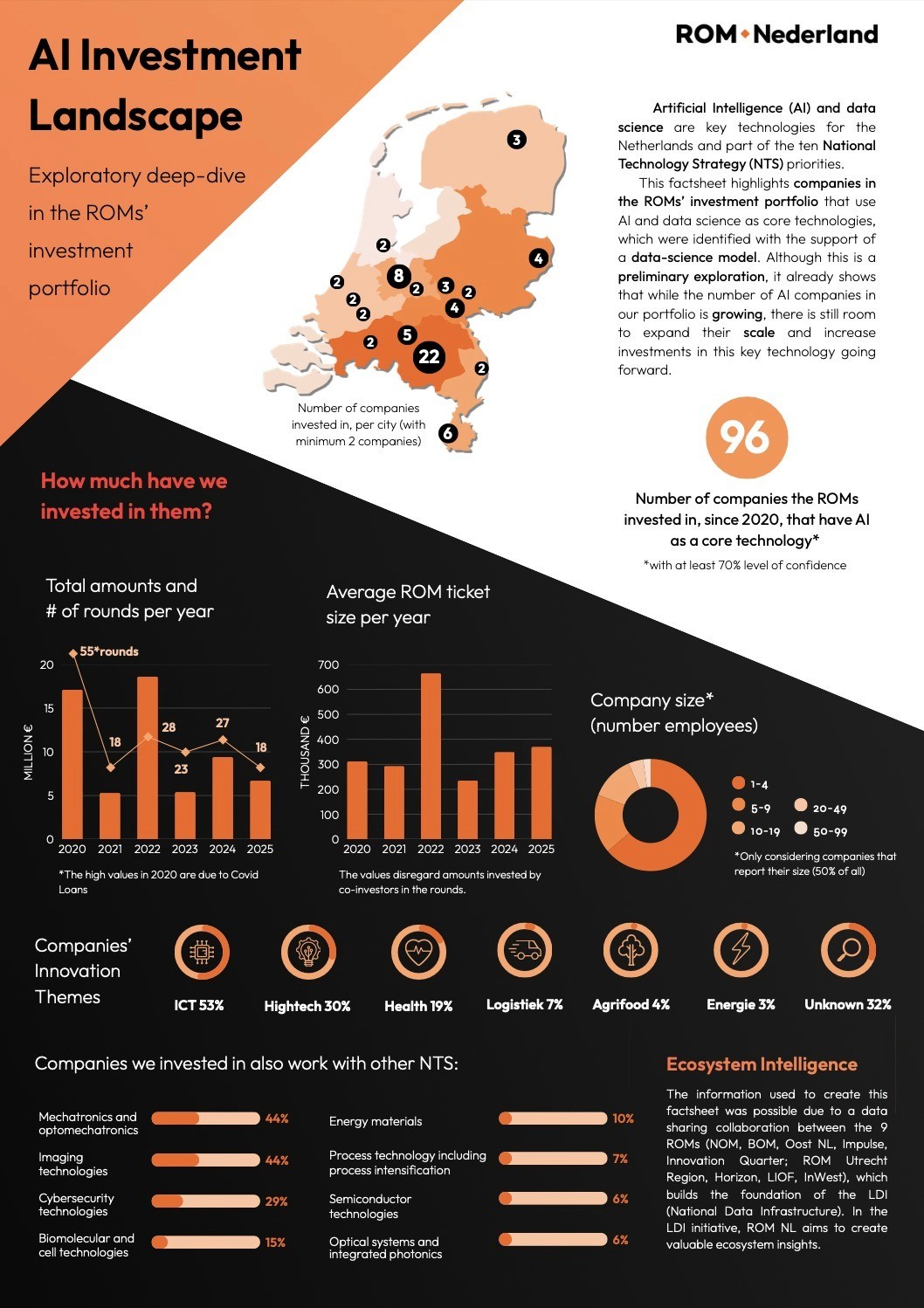

The nine ROMs, united under ROM Netherlands, present an impressive portfolio, visually summarized in the infographic below.

Since 2020, they have invested in 96 AI-native startups, companies where AI forms the core of the technology. Although the number of funding rounds normalized after the COVID peak in 2021, the average ticket size rose to nearly €400,000 by 2025, indicating a maturing market [2].

These companies are often still small. 55% have fewer than 10 employees, but they are rapidly growing and are crucial for the Netherlands' earning capacity and technological autonomy. The focus is on B2B applications in sectors where the Netherlands is traditionally strong. ICT (53%), high-tech (30%), and health (19%) dominate the portfolio.

Yet, the most striking observation is in the distribution over the AI stack. Only 2% of Dutch AI startups focus on hardware and energy, but this category attracts up to 18% of the invested capital. This is not a coincidence, but a deliberate, capital-intensive strategy to make a difference at the most fundamental layer of the AI stack. In comparison, 89% of the startups are in the application layer, drawing 76% of the capital [3].

"These AI companies are particularly important for the earning capacity of the future and the technological autonomy of the Netherlands and Europe. That’s why we want to actively accelerate their growth in the coming years," said Arjan van den Born, General Director at ROM Utrecht Region [2].

The five strategic opportunities according to Stefan Leijnen

The analysis by AI expert Stefan Leijnen, author of the Deep Dive report, sharply shows where the strategic opportunities lie. The report identifies five promising domains where the Netherlands can build a defensive and leading position [3].

Strategic Opportunity | Description | Why the Netherlands |

|---|---|---|

Vertical Applications | AI applications in sectors such as agrifood, logistics, energy, and high-tech. | The Netherlands has strong positions in these sectors, with proprietary data pipelines and strong adoption potential. |

Human and World Interfaces | Interfaces that collect data from the physical world (sensors, cameras). | Data from intelligence devices is growing faster than text data. Dutch leadership in responsible AI offers a strategic advantage. |

Data Sharing Platforms | Platforms that facilitate the sharing of data between companies. | European legislation creates financial incentives. The Netherlands can reduce fragmentation in data accessibility. |

Scientific AI | AI for fundamental research in life sciences, materials, and physics. | Strong academic research groups and model-driven, simulation-rich workflows. |

AI Hardware | Energy-efficient chips like photonic and neuromorphic hardware. | Strong Dutch semiconductor ecosystem. Hardware breakthroughs can break GPU dominance. |

These choices are not random. They align with where the Netherlands is already strong but require a conscious choice not to engage in the race for the largest language models. Instead, the focus is on applications where the physical world, data ownership, and energy efficiency are central.

The Netherlands in the global ranking and the painful reality

The Deep Dive report also contains a straightforward analysis of the Dutch position in the global AI race. The Netherlands ranks 20th worldwide on the Global AI Index, a ranking that assesses countries on their AI capabilities [3]. The scores present a mixed picture.

Category | Score (max 100) | Rating |

|---|---|---|

Infrastructure | 40 | Good |

Operating Environment | 67 | Good |

Government Strategy | 43 | Moderate |

Talent | 23 | Moderate |

Research | 10 | Weak |

Development | 11 | Weak |

Commercial | 10 | Weak |

The Netherlands scores well on infrastructure and the general business environment but poorly on research, development, and commercialization. This is a painful reality for a country that likes to see itself as an innovation hub. The scores point to a fundamental problem. We have the base, but we fail to convert knowledge into commercial successes.

The bottlenecks identified by startups themselves

The report also includes a survey of Dutch AI startups about the biggest bottlenecks they experience. The results are revealing and confirm what we pointed out in earlier articles [3].

The biggest bottleneck is funding (score 7 out of 10), followed by regulations, commercialization and sales, and talent. Access to data, computing power, and research score lower, suggesting that the infrastructure is fairly well in order but growth is hampered by a lack of capital and the difficulty of selling products.

This confirms the analysis from our earlier article on the AI Deltaplan. The knowledge is there, the infrastructure is there, but the money and space (both physical and regulatory) are lacking to grow to world players.

The energy paradox and the price of innovation

Another pain point highlighted in the report is the high energy price in the Netherlands. At €95 per MWh, the Netherlands pays more than double that of France (€32 per MWh) and significantly more than Germany (€46 per MWh) and Belgium (€56 per MWh) [3]. For AI companies that rely on computing power, this is a substantial competitive disadvantage.

While countries like France and Germany offer tax exemptions and compensations for data centers and AI infrastructure, these are largely missing in the Netherlands. This makes it harder for capital-intensive AI hardware startups to stay in the Netherlands despite the strong semiconductor industry and talented workforce present here.

From €400k tickets to €20-30 million. The valley of death

The report calls for ambitious industrial policy and puts a finger on the sore spot. To let the 96 startups of today grow into tomorrow's champions, larger investment rounds are needed. Specifically, the report mentions tickets of €20-30 million as crucial to bridge the gap to profitability. For companies aiming to grow into domestic champions that can compete globally in hardware and foundation models, even tickets of €100+ million are needed [3].

This is the proverbial 'valley of death' we signaled in earlier articles. The ROMs do an excellent job in the early phase with average tickets of €400k, and Invest-NL is focusing on larger, strategic investments. But there is a gap in the middle, where scale-ups get stuck because they are too big for early-stage investors and too small for the large funds.

"If the Netherlands and Europe want to remain economically competitive, technologically sovereign, and aligned with our values, now is the time to act. We invite policymakers, investors, entrepreneurs, and the broader AI community to join forces," said Gert-Jan Vaessen, Fund Manager of the Deep Tech Fund at Invest-NL [3].

Policy recommendations. From vision to action

The full Deep Dive report, with all analyses and recommendations, is available for download from the Invest-NL website. The report concludes with a series of concrete policy recommendations that go beyond just more money. It advocates for an integrated approach that combines knowledge, capital, and space.

Firstly, scale must be created and barriers removed for pension funds, insurers, and banks to invest in AI. Dutch pension funds invest three times as much in American companies as in European ones, a paradox we cannot afford [4].

Secondly, the report advocates for investment in an "AI Gigafactory of the future", a large-scale distributed deployment network that keeps sensitive data and vital infrastructure under democratic governance. This is not an argument for a central data center, but for a distributed network that aligns with European values of privacy and sovereignty.

Thirdly, structural barriers need to be removed in the areas of regulation, energy prices, and space for data centers. This requires European coordination, but the Netherlands can take a leading role here.

The engine is running, now accelerate

The message of the Deep Dive report is clear. The vision is there, the initial results are visible, and the engine of Dutch AI success is running. The 96 startups in the ROM portfolio are proof that the strategy works. But to turn these hidden champions into tomorrow's visible winners, more is needed than just good intentions.

It requires larger investment rounds, lower energy prices, fewer regulatory barriers, and an ambitious industry policy that combines knowledge, money, and space. It also requires a change in mentality. From sowing knowledge to reaping commercial successes. From facilitating startups to creating champions.

The question is no longer whether the Netherlands can become a serious AI player. The question is whether we have the courage to extend the strategy and make the investments necessary to move from vision to world leadership.

This article is an analysis and interpretation of the Deep Dive publication by ROM Netherlands and Invest-NL, and connects with previous coverage in Het Financieele Dagblad.

References

[1] Nederland kan met gerichte investeringen serieuze AI-speler worden, denkt Invest-NL. (2025, 26 november). Het Financieele Dagblad. https://fd.nl/bedrijfsleven/1578572/nederland-kan-serieuze-aispeler-worden-denkt-investnl

[2] Van den Born, A. (2025, 27 november). Deep Dive. hoe we AI vandaag omzetten in het verdienvermogen van morgen [LinkedIn post]. LinkedIn. https://www.linkedin.com/posts/arjanvandenborn_deep-dive-hoe-we-ai-vandaag-omzetten-activity-7399321942519549952-tbCR

[3] Leijnen, S. (2025, november). AI Deep Dive. Strategic investing in the age of intelligence. Invest-NL & ROM-Nederland. https://www.invest-nl.nl/nl/nieuws/nederland-moet-inzetten-op-next-gen-en-energie-efficiente-ai

[4] Beleggingen pensioenfondsen in Amerikaanse bedrijven fors groter dan in Europese ondernemingen. (2025, 17 april). De Nederlandsche Bank. https://www.dnb.nl/algemeen-nieuws/statistiek/2025/beleggingen-pensioenfondsen-in-amerikaanse-bedrijven-fors-groter-dan-in-europese-ondernemingen/

Read More

Join

DutchStartup.AI

Secure your place in the Dutch AI ecosystem now

Join

DutchStartup.AI

Secure your place in the Dutch AI ecosystem now

Join

DutchStartup.AI

Secure your place in the Dutch AI ecosystem now

Dutch AI

Built Different

An initiative by Willem Blom & Max Pinas | Powered by Studio Hyra

Dutch AI. Built Different 2025

Dutch AI

Built Different

An initiative by Willem Blom & Max Pinas

Powered by Studio Hyra

Dutch AI. Built Different 2025

Dutch AI

Built Different

An initiative by Willem Blom & Max Pinas | Powered by Studio Hyra

Dutch AI. Built Different 2025